Watch

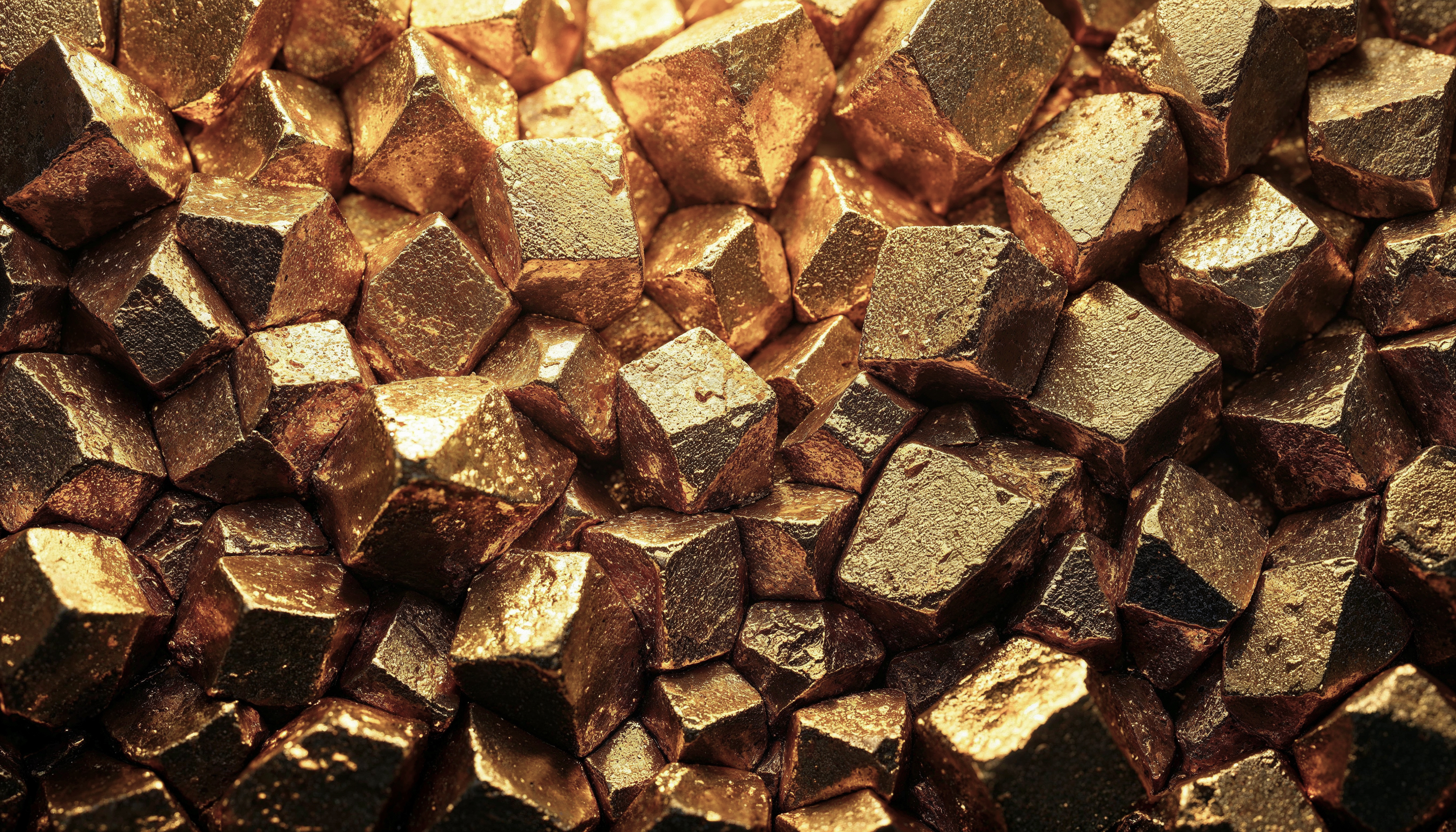

Copper, the "metal of electrification," stands at the epicenter of the global transition towards a greener, more connected world. In 2025, the global copper market is navigating a pivotal moment, defined by a powerful collision between surging, structurally-driven demand and increasingly constrained supply. As nations and corporations scramble to secure this critical metal, a new powerhouse is emerging in the supply chain: Indonesia. Driven by an aggressive government policy to capture more value from its resources, Indonesia is transforming from a mere supplier of raw materials into a major producer of refined copper, creating an unprecedented opportunity for downstream investors to position themselves at the heart of the new copper economy.

The Global Demand Surge: A Structural Supercycle

The demand for copper is not a cyclical trend; it is a long-term structural supercycle fueled by the unstoppable forces of decarbonization and digitalization. Global copper demand is projected to continue its steady upward climb, growing by approximately 2% in 2025. Forecasts from the International Energy Agency see refined copper demand rising from 27 million tonnes in 2024 to 31 million tonnes by 2030.

This growth is anchored in several key sectors:

●Electric Vehicles (EVs): An electric vehicle requires approximately 83 kg of copper, significantly more than a traditional internal combustion engine vehicle.

●Renewable Energy: Green energy systems like solar and wind farms are far more copper-intensive than their fossil fuel counterparts.

●Grid Modernization and Digital Infrastructure: The expansion of electricity grids, data centers, and 5G networks all rely heavily on copper's superior conductivity.

Asia, particularly China and India, is the engine of this demand, accounting for nearly 74% of global copper consumption. For investors, this data paints a clear picture of a sustained, long-term demand curve for any products derived from copper.

The Supply Side Squeeze and Market Volatility

While demand soars, the supply side is struggling to keep pace. The market is facing significant constraints, including aging mines, declining ore grades in major producing nations like Chile and Peru, stricter environmental regulations, and rising resource nationalism. Critically, the lead time for developing a new copper mine is nearly 18 years, meaning new primary supply cannot be brought online quickly to meet sudden demand spikes.

This dynamic has led many analysts to forecast a supply deficit for 2025 of around 180,000 tons. While some organizations like the International Copper Study Group (ICSG) project a temporary surplus due to the potential impacts of trade policies on demand, the overarching theme for investors is one of volatility and uncertainty. In such an environment, securing a stable, reliable, and geographically diversified source of refined copper becomes a massive strategic advantage.

The Global Price Outlook & The Rise of Indonesia

This tight market fundamental is reflected in a bullish consensus on copper prices among the world's leading financial institutions. Forecasts for 2025 are strong, signaling high potential margins for efficient producers and downstream manufacturers.

|

Investment Bank |

H2 2025 Average Forecast ($/tonne) |

Peak Price Projection ($/tonne) |

Key Drivers Cited |

|

Goldman Sachs |

$9,890 |

$10,050 (Aug 2025) |

Tariffs, inventory drawdowns |

|

JPMorgan |

$9,500 |

$9,800 (Oct 2025) |

Infrastructure spending |

|

Citi |

$10,200 |

$10,350 (Sep 2025) |

Green energy transition |

|

Morgan Stanley |

$9,100 |

$9,400 (Q4 2025) |

Supply constraints |

|

Bank of America |

$9,650 |

$9,950 (Aug 2025) |

EV demand growth |

|

UBS Research |

- |

$11,000 |

Ongoing supply deficit |

It is within this context of high prices and supply uncertainty that Indonesia's strategic shift becomes so significant. Holding approximately 3% of the world's copper reserves, the nation is in a strong position to help meet global demand. More importantly, the Indonesian government has implemented a game-changing downstreaming policy, banning the export of raw copper concentrate to force the development of a domestic processing and refining industry.This policy is fundamentally altering global copper trade flows. Indonesia is no longer content to simply export its raw wealth; it is determined to become a major global supplier of high-value, refined copper cathodes.

As the global copper market grapples with the challenges of the energy transition, Indonesia is making a bold move to capture a greater share of the value chain. This creates a historic opportunity for downstream manufacturers to build their operations at the source, in a nation poised to become a critical and stable node in the global copper supply network.

In our next article, we will delve into Indonesia's copper downstreaming mandate and what it means for your business.